Bitcoin Stronger pioneer of cryptocurrencies, is poised for strength as it approaches its halving event. Grayscale, a prominent crypto asset management firm

suggests that Bitcoin may experience a significant price surge following this event due to decreased selling pressure and growing interest in Bitcoin-based applications.

Understanding Bitcoin Halving

Bitcoin halving is an integral part of the cryptocurrency’s protocol designed to reduce inflationary pressure. This mechanism cuts the rewards in half for successfully mining a bitcoin block, making the process more challenging. Historically, halving events have preceded bullish trends in Bitcoin’s price.

Bitcoin’s Strength Before Halving

Grayscale’s research highlights the remarkable growth in Bitcoin’s technical fundamentals and use cases leading up to the halving event. Despite short-term challenges faced by miners, the fundamental on-chain activity and positive market structure updates indicate a stronger foundation for Bitcoin compared to previous halving cycles.

Ordinals and Bitcoin’s On-chain Activity

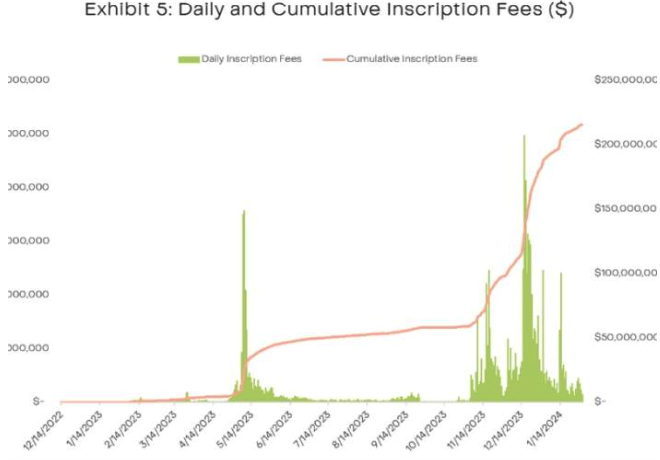

The introduction of ordinal inscriptions and BRC-20 tokens has revitalized on-chain activity on the Bitcoin network. These innovations have generated substantial transaction fees for miners and brought renewed developer interest to the Bitcoin blockchain. Ordinals, embedded within the Bitcoin blockchain, have emerged as a significant source of income for miners.

Bitcoin’s Market Structure Pre-Halving

With lower block rewards post-halving, the market is anticipated to require relatively lower buying pressure to sustain prices. Grayscale’s report suggests that decreased selling pressure coupled with increased demand could lead to higher Bitcoin prices. The ongoing accumulation of bitcoins by spot Bitcoin ETFs further reinforces this positive market structure.

The Role of Spot Bitcoin ETFs

Spot Bitcoin ETFs have garnered significant attention from investors seeking exposure to Bitcoin without direct ownership. These funds, which accumulate bitcoins on behalf of investors, have witnessed substantial inflows within a short period. Their presence in the market is expected to contribute to the overall demand for Bitcoin post-halving.

Conclusion

In conclusion, Bitcoin appears to be on a stronger footing as it approaches its halving event. The combination of enhanced on-chain activity

favorable market dynamics, and growing investor interest suggests promising prospects for Bitcoin’s price performance in the near future.

FAQs

- What is Bitcoin halving, and why is it significant? Bitcoin halving refers to the process of reducing block rewards for miners, aiming to control inflation. It’s significant as it affects the supply dynamics of Bitcoin, often leading to price appreciation.

-

How do Ordinals impact Bitcoin’s on-chain activity? Ordinals facilitate the embedding of data on the Bitcoin blockchain

contributing to increased transaction fees for miners and renewed developer interest in the network. -

What role do spot Bitcoin ETFs play in the market? Spot Bitcoin ETFs allow investors to gain exposure to Bitcoin without direct ownership

leading to increased demand for the cryptocurrency. -

Why is Bitcoin often referred to as digital gold? Bitcoin’s limited supply and decentralized nature share similarities with gold

making it a popular store of value and hedge against inflation. -

What the potential risks associated with Bitcoin halving? While Bitcoin halving historically precedes bullish trends

there are risks such as market volatility and regulatory uncertainty that investors should consider.