European Stocks Tread a tentative start to the trading year in 2024, with a slight slip observed on the first day. As bonds experienced a retreat, energy shares emerged as the outperformers, riding the rally in crude oil prices fueled by escalating tensions in the Red Sea.

Key Highlights from European Markets:

1. European Stocks Tread Modest Decline:

- The Stoxx Europe 600 initially recorded gains of up to 0.7% but later reversed course, dropping 0.2% at 12:03 p.m. in London.

- The market sentiment was influenced by movements in bond yields, with 10-year U.S. and German bond yields rising as investors speculated on the extent of easing by the Federal Reserve in 2024.

2. Energy Stocks Surge:

- Energy stocks outperformed, driven by an increase in crude oil prices. The rise in tension over the Red Sea, including Iran’s deployment of a warship in response to the U.S. Navy’s actions, contributed to the gains.

- AP Moller-Maersk A/S experienced a rise after suspending transit through the Red Sea following an attack on one of its ships by Houthi rebels.

3. Sectoral Performance:

- Consumer products and technology stocks lagged behind the overall market performance.

- Individual stocks like ASML Holding NV faced a decline after reports suggested the cancellation of some machine shipments to China at the request of the U.S. President Joe Biden’s administration.

4. Geopolitical Tensions and Market Dynamics:

- Escalating tensions in the Middle East, particularly involving Iran and the Red Sea, added complexity to geopolitical dynamics.

- The move by Iran and the broader geopolitical situation could impact global trade, emphasizing the interconnectedness of markets with geopolitical events.

5. China’s Factory Activity and Economic Outlook:

- A private gauge of China’s factory activity showed momentum in December, contrasting with official data indicating fragility in the outlook for manufacturers.

- European firms, which have significant exposure to China, are likely monitoring developments in the Chinese economy.

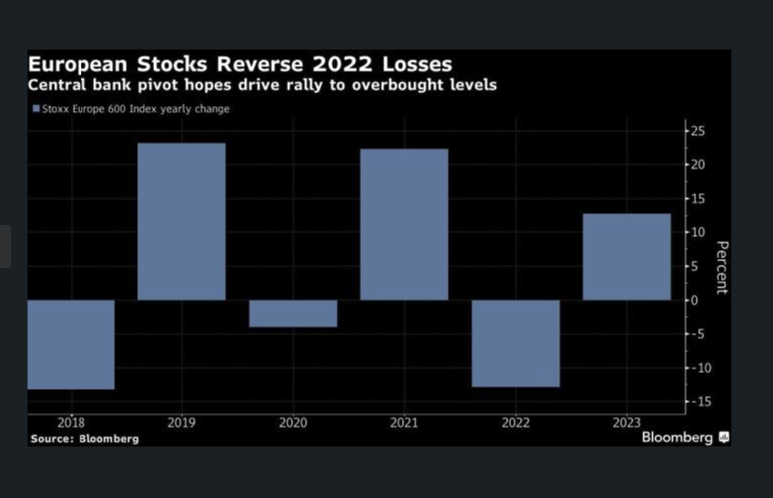

6. Market Sentiment in 2023 and Future Outlook:

- European Stocks Tread posted a robust performance in 2023, gaining 13% amid optimism about central banks potentially shifting to interest rate cuts.

- The Stoxx 600 reached overbought levels, as indicated by its 14-day relative-strength index.

7. Focus on Eurozone Inflation Data:

- Eurozone inflation figures scheduled for later in the week are anticipated to provide insights into monetary policy decisions.

- The market’s reaction to inflation data could be crucial, as hopes for rapid rate cuts have been a driving force behind the recent rally.

8. Cautious Outlook and Consolidation Expectations:

- Analysts remain cautious in the short term, pointing to overbought market conditions that might necessitate a consolidation phase.

- The need for markets to consolidate before sustaining another significant upward movement is emphasized.

Conclusion:

European markets navigate a complex landscape marked by geopolitical tensions, economic data, and global dynamics. The cautious start to 2024 reflects the intricate balance investors seek amid uncertainties. As attention turns to upcoming economic indicators and geopolitical developments

market participants remain vigilant, recognizing the potential impact on stocks and sectors. The evolving market sentiment will likely be shaped by geopolitical events, central bank decisions

and economic data releases in the weeks ahead.