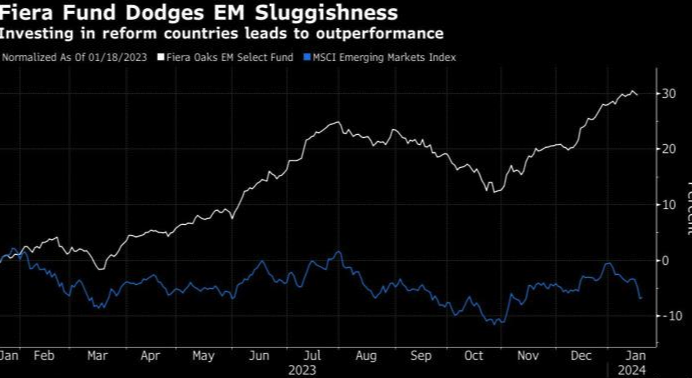

Fiera Capitals-based Corp.’s EM Select Fund has outperformed 99% of its peers by delivering a remarkable 29% return to investors in the past 12 months. The success of the fund is attributed to its unique strategy, which focuses on countries undergoing significant economic transformations rather than being solely influenced by global monetary conditions, including potential Federal Reserve rate cuts.

I. Overcoming the Fed Factor

Dominic Bokor-Ingram, co-manager of the EM Select Fund, emphasizes that the fund’s gains are derived from strategic investments in under-owned markets, such as Greece, Saudi Arabia, and Vietnam. Unlike many equity investors who closely track and respond to Federal Reserve policies, Bokor-Ingram’s approach is to prioritize domestic reforms and economic transformations within specific countries.

II. Unique Investment Approach

Fiera Capitals is characterized by its insensitivity to the relative impact of Federal Reserve policies. Instead, the firm places a significant emphasis on the potential success of domestic reforms and their outcomes. Bokor-Ingram believes that countries implementing reforms independently of global monetary conditions provide attractive investment opportunities.

III. Key Success Factors

The Fiera Capitals Oaks EM Select Fund has significantly outperformed the MSCI Emerging Markets Index, registering nearly five times the gain of the benchmark in 2023. The success is attributed to a focus on countries that are actively resetting their economic policies and implementing reforms. Bokor-Ingram identifies Vietnam

Greece, and Saudi Arabia as the fund’s surest bets due to their commitment to reforms and being under-owned by international investors.

IV. Spotlight on Selected Countries

- Vietnam: Progressing towards potential inclusion in MSCI emerging-market status, with economic and market-structure reforms supporting its candidacy.

-

Greece: Under Prime Minister Kyriakos Mitsotakis, Greece has earned praise for structural reforms

and its bonds will join elite indexes in 2024. - Saudi Arabia: Experiencing non-oil economic expansion, with investments in industries such as semiconductors, space, and electric car manufacturing.

V. Market Expansion and Opportunities

Fiera Capital is optimistic about the potential resolution of the Russia-Ukraine war, which could positively impact eastern European stocks. Argentina and Turkey are also under consideration, with Argentina experiencing a surge in its Merval Index due to expectations of fiscal sustainability.

VI. Markets to Avoid

Fiera Capital has identified markets to avoid in 2024, including Egypt, Nigeria, Kenya, Bangladesh, and Pakistan. Reasons range from conflict risks along the Red Sea shipping route to economic challenges such as stalled reforms, high inflation

debt problems, and circular debt issues.

VII. Forward-Looking Strategies

Fiera Capital’s approach is proactive, continually monitoring economic transformations and policy changes in various countries. As the firm keeps an eye on potential opportunities in Argentina and Turkey, its emphasis on avoiding markets with existential risks reflects a commitment to preserving capital in the ever-evolving global investment landscape.