SoftBank, a renowned Japanese conglomerate, recently reported a staggering $6.2 billion quarterly loss amidst an investment gain in its Vision Fund. The company’s financial performance in the September quarter failed to meet expectations, reflecting a complex set of challenges, including the ramifications of the WeWork bankruptcy. Let’s delve deeper into the intricacies of SoftBank’s financial journey and its intricate relationship with various high-profile investments.

SoftBank’s Second Quarter Performance

- Net Sales Surpass EstimatesSoftBank’s net sales for the quarter amounted to 1.67 trillion Japanese yen, exceeding the projected 1.6 trillion yen, indicating a resilient performance despite the overarching losses.

- Mounting Net LossContrarily, the conglomerate recorded a substantial net loss of 931.1 billion yen, far surpassing the expected loss of 114.1 billion yen. The devaluation of the yen against the dollar significantly impacted its bottom line due to numerous U.S.-dollar denominated liabilities.

Vision Fund’s Roller Coaster Ride

- Mixed Results of the Vision FundSoftBank’s Vision Fund experienced a tumultuous ride, showcasing an investment gain of 21.3 billion yen, attributed primarily to the sale of shares in chip designer Arm to a SoftBank subsidiary. However, the fund faced setbacks due to the depreciation of several key investments, notably Chinese AI firm SenseTime.

- WeWork Bankruptcy ImpactSoftBank grappled with a pre-tax loss of 258.86 billion yen in its Vision Fund segment, owing to the distressing repercussions of WeWork’s insolvency. The conglomerate encountered a 234.4 billion yen loss linked to its investments and financial assistance to WeWork, once a promising venture that ultimately filed for Chapter 11 bankruptcy protection.

SoftBank’s Road to Recovery

- Lessons from the WeWork FiascoSoftBank’s Chief Financial Officer, Yoshimitsu Goto, acknowledged the need for introspection following the WeWork debacle. He emphasized the necessity of assimilating the lessons from this experience into the company’s future investment strategies, hinting at a potential shift in approach.

- Strategic Pivots and AI FocusDespite the setbacks, SoftBank’s strategic focus on artificial intelligence remains unwavering. Goto highlighted the company’s commitment to be at the forefront of the AI revolution, showcasing a firm determination to leverage technological advancements for future growth.

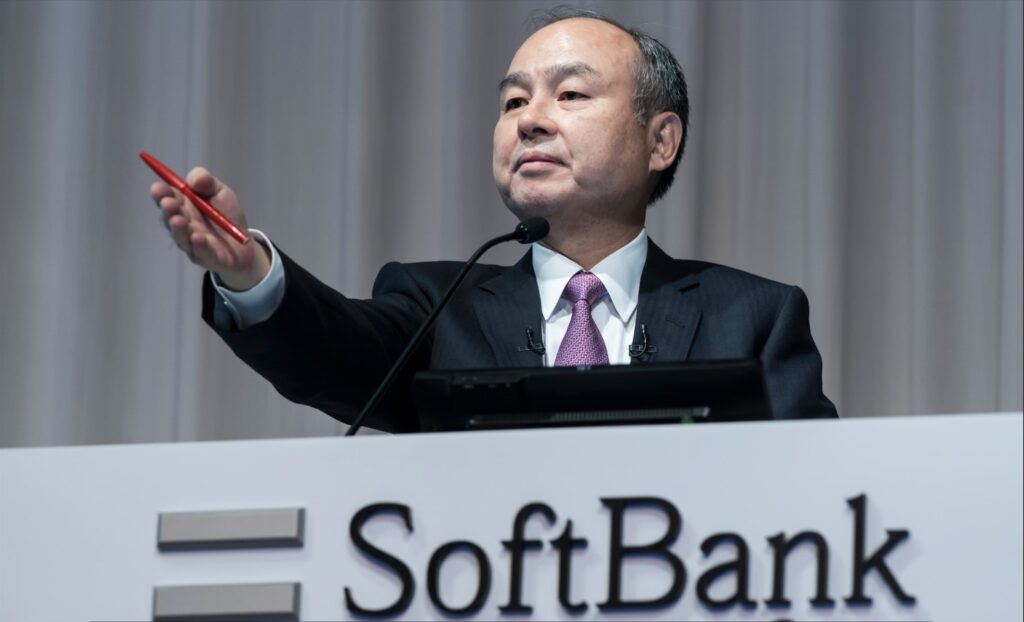

- Masayoshi Son’s AbsenceMasayoshi Son, the visionary founder of SoftBank, has been notably absent from recent earnings presentations. Despite his physical absence, Goto affirmed Son’s continued involvement in discussions concerning the potential changes AI could bring to people’s lives.

Arm’s Journey and SoftBank’s Endeavors

- Arm’s Public OfferingSoftBank’s acquisition, chip designer Arm, went public during the fiscal second quarter, marking a significant milestone for the company. The successful IPO valued Arm at over $50 billion, indicating a substantial return on SoftBank’s initial $32 billion investment in 2016.

- Initial Success and Future ChallengesAlthough Arm reported a rise in annual revenue for the September quarter, the firm’s outlook for the December quarter fell short of investor expectations, leading to a temporary decline in its share value during after-hours trading in the U.S.

Conclusion

SoftBank’s recent financial performance, characterized by a substantial quarterly loss and the aftermath of WeWork’s bankruptcy, underscores the inherent volatility and risks prevalent in the world of high-stakes investments. However, the company’s unwavering commitment to AI and its ongoing efforts to learn from past failures signal a resilient approach aimed at charting a more stable and prosperous future.

FAQs

- How has SoftBank’s performance been historically?SoftBank’s historical performance has been characterized by both significant successes and notable failures, particularly in the realm of high-risk, high-reward investments.

- What led to the significant quarterly loss for SoftBank?Factors such as the devaluation of the yen against the dollar and the repercussions of WeWork’s bankruptcy were key contributors to SoftBank’s substantial quarterly loss.

- How is SoftBank planning to mitigate future risks?SoftBank aims to adopt a more cautious investment approach, integrating the lessons learned from the WeWork incident, and focusing on emerging technologies, especially artificial intelligence.

- What impact does Arm’s performance have on SoftBank’s overall financial trajectory?Arm’s performance, though initially promising, underscores the challenges associated with maintaining stable growth in the semiconductor industry,